The hot labor market hasn’t resulted in a pay boost for the majority of Americans.

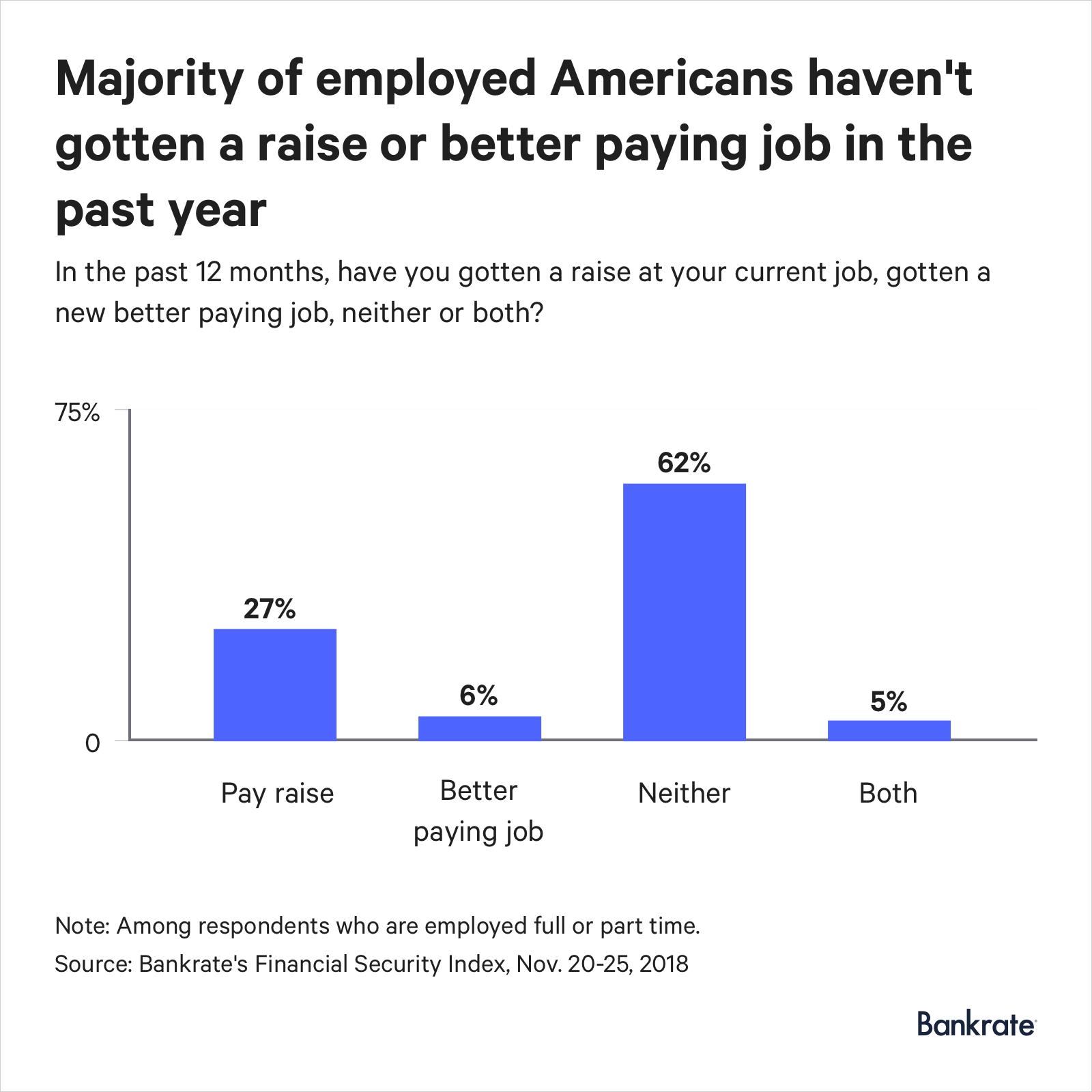

A new Bankrate survey finds that among employed Americans, 62 percent report not getting a pay raise or better paying job in the past year. That’s up from last year, when 52 percent said they had not received a pay raise or better paying job. Yet, only 25 percent of respondents in the new survey say they’ll look for a new job in the next year.

“Career advancement often involves a willingness to change jobs, particularly in the early career years,” said Greg McBride, CFA, chief financial analyst for Bankrate.com.

Fewer workers report getting pay raises or better paying jobs than last year

Mike Gnitecki, a licensed paramedic in Longview, Texas, is one of the Americans whose wages flatlined.

Because of a pay freeze at his previous employer, the University of Texas Health hospital system, he hadn’t seen a pay increase for the past three years. He’s been stuck at a base pay of $43,500 a year, with the opportunity for overtime.

“It basically feels like my pay has dropped each year due to normal cost-of-living increases,” Gnitecki says. “At the same time, my experience and responsibility has increased.”

The percentage of survey respondents who reported getting a raise was 32 percent, compared with 38 percent last year. Only 11 percent of respondents got a better paying job, also down from 18 percent last year. Percentages include those who received both, or five percent of respondents.

Gnitecki got both a new job and a raise.

Gnitecki describes feeling “frustrated,” but he reached a turning point when one of his friends sent him an article that said the only way to get a pay increase in the current economy would be to switch jobs. So, he set off on a hunt for a new one — and found a similar paramedic job elsewhere with a “decent increase” and benefits.

He starts the new job in December.

“It feels really good because it kind of feels like I’m being paid how much I should be paid,” Gnitecki says. “I’m very glad I made the switch.”

Gnitecki’s experience dovetails with a larger trend in the economy. While the unemployment rate is a decades-low 3.7 percent, wages have struggled to pick up. After accounting for inflation, October’s average wage had about the same purchasing power it did 40 years ago, according to Pew Research.

McBride says the economy might be doing great right now, but productivity isn’t following suit and can account for why wages aren’t growing.

“The economy might be doing better, but employees aren’t cranking out more output per hour of work,” McBride says. “A technological advancement or breakthrough could help, and in a lot of ways, just how work is done could be more efficient in the workplace.”

Households in the lowest income brackets were the least likely to report getting a pay raise or a better paying job, with 76 percent stating they received neither.

As a result, the lowest income households (under $30,000) have the highest likelihood of looking for a new job in the next 12 months, at 42 percent, compared with just 17 percent of the highest income households ($75,000 or more).

Younger workers more likely to seek new jobs, get raises

Younger Americans are making moves.

Younger millennials, ages 18-27, were the most likely age group to get a promotion or new job responsibilities that resulted in a pay raise. They’re also the most likely age group to say they’ll look for a new job in the next 12 months.

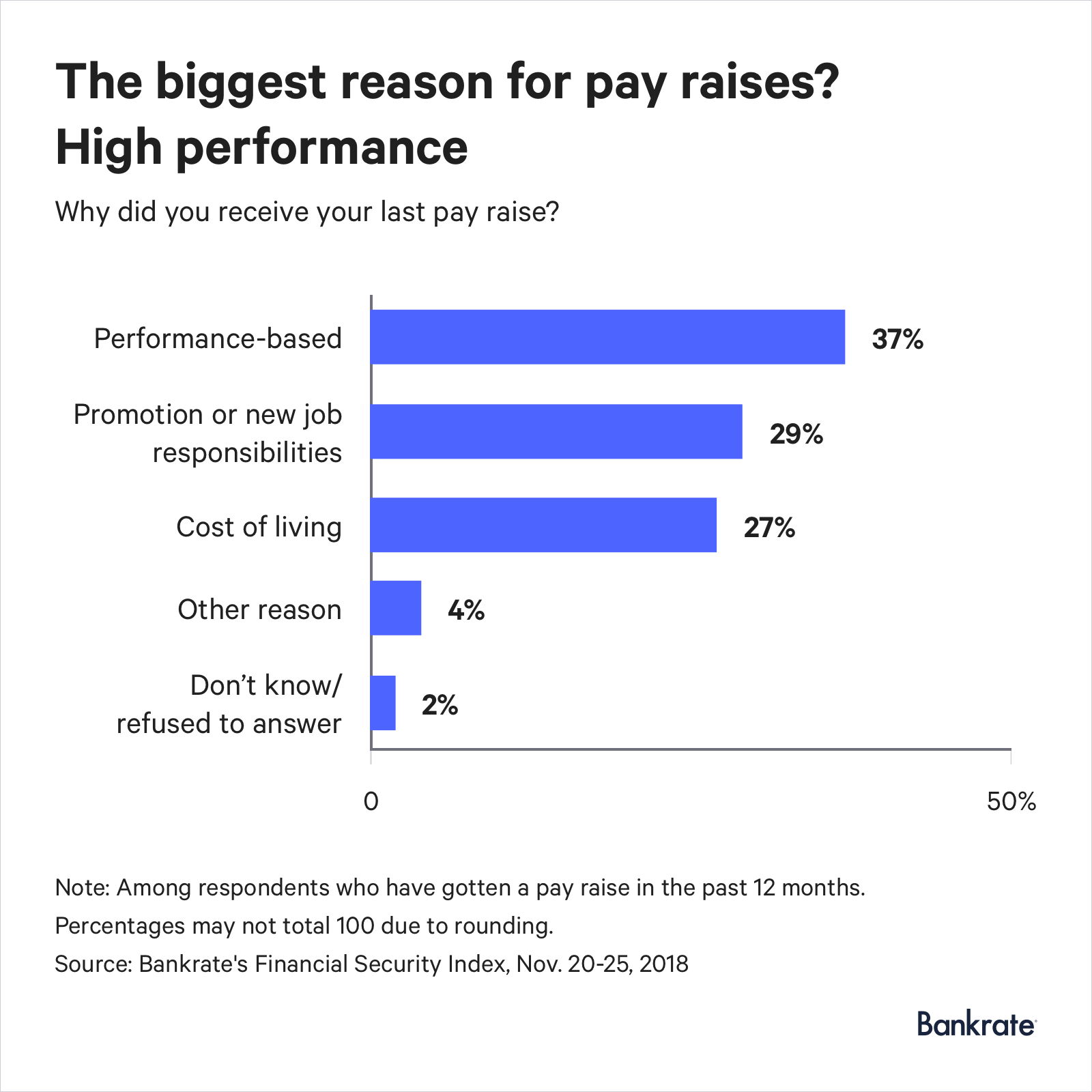

Among all respondents who got a raise, 37 percent reported it being performance-based, showing no difference from last year’s survey. About 29 percent cited raises because of a promotion or new job responsibilities, up from 24 percent last year. About 27 percent stated a raise was given as a cost-of-living increase, also unchanged from last year. Just 4 percent cited a raise for some other reason.

Although wages are stagnant, most Americans still hold faith in the job market.

The survey found that around 91 percent of respondents cited having the same or greater confidence in the job market than one year ago. Only 9 percent said they have lower confidence.

However, confidence in the job market increased with income: 38 percent of households earning $75,000 or more had increased confidence in the job market, compared with 24 percent of households earning under $30,000.

Baby boomers least likely to get a raise

The survey also found that raises varied by generation, too.

Older baby boomers, ages 64-72, had the highest incidence of reporting neither a pay raise nor a better paying job, at 79 percent. This generation is at their peak earning potential, McBride says, and opportunities tend to dissipate at this stage.

That doesn’t mean it’s too late for them to earn more, though.

“They should continue to grow and acquire more skills,” McBride says. “And stay on top of technology and be forward thinkers.”

McBride adds that millennials aren’t capitalizing on the current opportunity’s full potential.

“Career advancement often involves a willingness to change jobs, particularly in the early career years,” McBride says. “Yet only one-third of all millennials intend to capitalize on this tight labor market and look for a new job in the next 12 months.”

McBride says the best way to take advantage of the current job market is to learn new skills and keep current ones sharp. He adds that if individuals can do that at their current job, they should — it’s when they can’t that they might want to seek employment elsewhere.

Methodology

This study was conducted for Bankrate via telephone by SSRS on its Omnibus survey platform. The SSRS Omnibus is a national, weekly, dual-frame bilingual telephone survey. Interviews were conducted from Nov. 20-25, 2018 among a sample of 1,000 respondents in English (961) and Spanish (39). Telephone interviews were conducted by landline (402) and cellphone (598, including 369 without a landline phone). The margin of error for total respondents is +/-3.61 percent at the 95 percent confidence level. All SSRS Omnibus data are weighted to represent the target population.

View the original article by Bankrate.com (Kelly Anne Smith) here. Header photo courtesy of freedigitalphotos.net/Sira Anamwong.